Online Bookkeeping Services | Small Business Bookkeeping | Bookkeeping Startups

Bookkeeping services that will make your accountant smile.

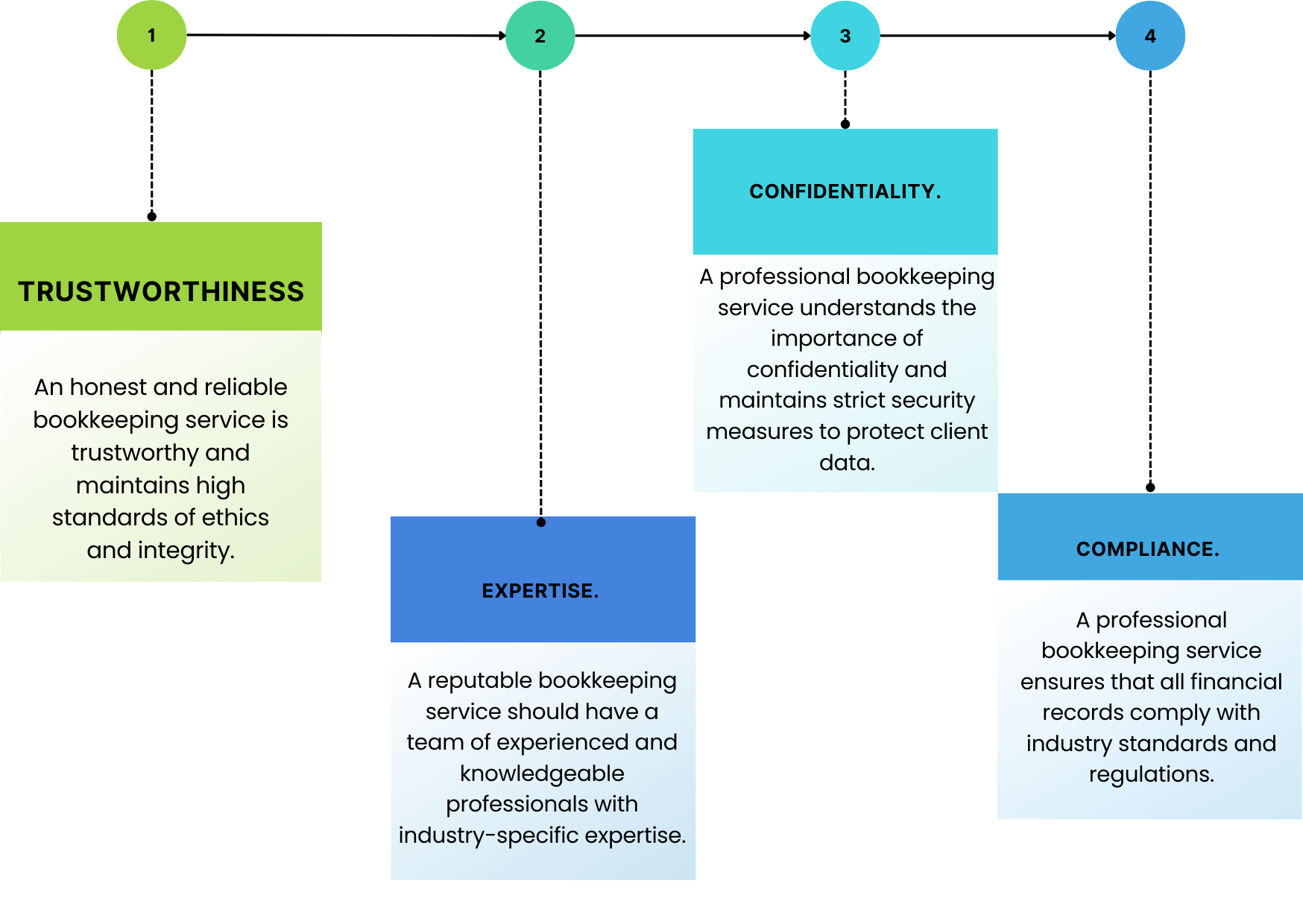

Optimize your small business with Cali Bookkeeping's expert bookkeeping services. We deliver accurate, reliable financial records for long-term success.